Implications of the Constellation Calpine Combination

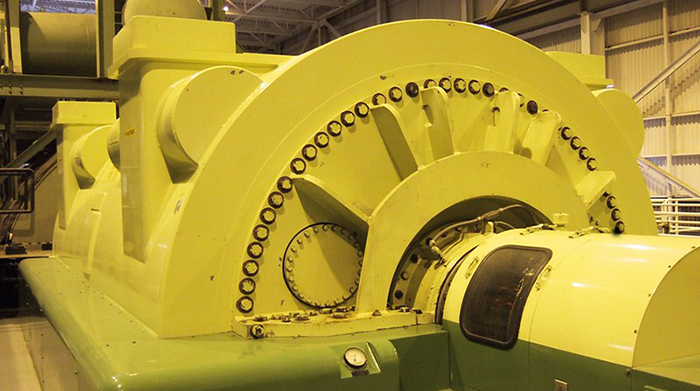

Image courtesy of kqedquest under Attribution-NonCommercial 2.0 Generic Deed, resized to 700 x 391 pixels.

Constellation Energy just announced it is acquiring Calpine for an equity purchase price of $16.4 billion to create the largest power generator in the U.S. This is a massive deal that helps both companies as they navigate the seas of change happening within and across the power industry.

Why the Calpine Acquisition Makes Sense for Constellation

The deal combines Constellation’s nuclear assets with Calpine’s gas and geothermal assets. Overall, Calpine has 79 energy facilities in operation that generate a total of 27k MW of power serving 22 states and Canada.

The locations of Calpine’s assets – which are concentrated in the Mid-Atlantic and Northeast regions, as well as California and Texas – fit perfectly with Constellation’s footprint.

With the acquisition, Constellation will own roughly 60 GW of generating capacity across a variety of renewable energy sources such as nuclear, natural gas, geothermal, hydro, wind, solar, cogeneration and energy storage technologies. The coast-to-coast geographic footprint will cover California, New York, Pennsylvania, Virginia, Texas, Delaware, and other growing markets for power demand.

There are several benefits of this acquisition:

- Increased reliability, as the diversity in the generation mix should provide a hedge against largescale outages.

- The ability to meet the future demand from data centers, AI, and other power-hungry users.

- The combined entity will largely be a clean energy producer, which obviously helps from a climate perspective.

- Economies of scale should increase, driving down certain costs and therefore increasing the amount available for capital upgrades.

So, yes, there would seem to be many benefits for both Constellation and Calpine, but it will take some time before they can be realized. The cash and stock transaction must be approved be various regulatory agencies including the Federal Energy Regulatory Commission (FERC), the Canadian Competition Bureau, and multiple state utility commissions, and is expected to take around a year.

From my chair, I think this is a good thing. The combination of the assets of Constellation and Calpine should improve reliability, increase capital upgrades, more easily meet future power demand, and do its part for the climate. Sounds like a win to me!